Anyone who is self-employed knows the agony of paying taxes. It can sometimes seem as if the government doesn’t want people to be entrepreneurial. The demands for quarterly payments, the requirement to pay double the taxes of other workers and the headaches of staying on top of everything can be frustrating and confusing when all you’re trying to do is make ends meet. Understanding how self-employment tax works is the first step in minimizing what you have to pay while keeping right with the IRS.

What Is Self-Employment Tax?

Self-employment tax refers to the means by which an independent contractor or 1099 worker pays Social Security and Medicare taxes. When working a regular job, your employer pays half of the government Social Security tax. This comes out to 7.65% of your wages. When self-employed, you have no employer to do this, so you have to pay the full 15.3% tax.

This tax covers your 12.4% Social Security tax and your 2.9% Medicare taxes. These are figured against the Social Security wage base of $118,500, the maximum wages from self-employment that are subject to this tax.

Schedule SE Deductions

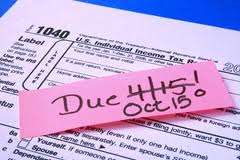

When self-employed, you have to file a Schedule SE every year. This schedule is how you calculate the total self-employment tax owed. However, many people don’t realize that you can deduct part of these payments as an income adjustment on your 1040 form. This deduction can be anywhere from 50-57% of all self-employment tax payments. The total amount you can deduct depends on your self-employment income.

S-Corp Savings

Many who are self-employed set themselves up as a corporation or limited liability corporation (LLC). These people have further opportunities to reduce tax liability from self-employment. Under an S Corp, you can draw a salary from your earnings and turn the rest of your profits around back into the business. In this case, only the amount you draw as a salary is subject to self-employment taxes.

Net Profit Reduction

Schedule C is the form used to determine your net self-employment profit for purposes of calculating self-employment taxes. It is calculated by subtracting deductible business expenses from gross income. The lower the total, the lower your taxes.

This means maximizing your deductions is vital to a low tax payment. Be extremely thorough and deduct everything you legally can. This is not cheating the system; it’s built in to help those who are self-employed. Just be sure you are being honest and that all of the expenses you deduct are necessary to your business and ordinary expenses. Things like a home office deduction, mileage on your vehicle, office supplies and equipment, utilities, medical expenses, market research supplies, professional memberships and insurance are all normal deductions.

Calculating self-employment tax can be confusing and tricky for many people. This is why it’s a good idea to have a qualified accountant help you out at tax time. If you would like help with these issues, check out our tax services and give us a call today!