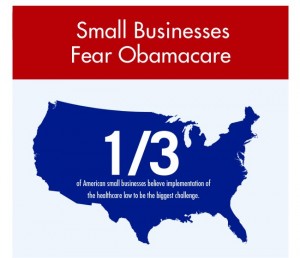

For the last few years, it seems that every day someone in the media or an elected official is talking about the pros or the cons of Obama Care, or as it is formally known, the Affordable Care Act. But, little coverage has been made on the implications to small businesses and sole proprietors that feed the U.S. economy. It is now more important than ever before that sole proprietors have the expertise of a tax accountant to help guide the way through this tricky maize of healthcare and its tax implications. In the first part of this two part series, we examine the implications of the Affordable Care Act on Sole Proprietors.

For the last few years, it seems that every day someone in the media or an elected official is talking about the pros or the cons of Obama Care, or as it is formally known, the Affordable Care Act. But, little coverage has been made on the implications to small businesses and sole proprietors that feed the U.S. economy. It is now more important than ever before that sole proprietors have the expertise of a tax accountant to help guide the way through this tricky maize of healthcare and its tax implications. In the first part of this two part series, we examine the implications of the Affordable Care Act on Sole Proprietors.

Sole Proprietors and the Self-Employed are facing many changes under the new legislation as far as tax consequences, and for medical coverage. 2014 brings the “Individual Shared Responsibility Provision” that requires each individual to carry basic health insurance coverage, pay a fine (known as the Shared Responsibility Payment) or qualify for an exemption. Exemptions are rare and require proof of hardship, or proof that religious beliefs somehow prevent coverage.

Sole Proprietors have three options when it comes to healthcare insurance. If you have had continuous coverage under the same plan since before March 23, 2010, you can be grandfathered in and safe from the repercussions of the

Affordable Care Act. You can also choose and pay for a new healthcare plan through an exchange (or broker), or you can choose not to have health insurance and pay the fine through the IRS next year.

For some self-employed and sole

proprietors, the fine for the 2014 calendar year is relatively small, and it may make more sense, in the terms of finances. However, unless you have the finances to self-insure if a health condition or accident happens, it is wise to carry at least the minimum insurance required under Obama Care. It is important to note that if you are currently carrying a Catastrophic Plan (as many self-employed have been advised by their accountants), it may not meet the new requirements for minimum coverage.

Penalty For Not Carrying Minimum Insurance

The penalty is based on household

income, and is being phased in gradually over the next 3 years. It is the greater number of income percentage or the minimum fee below:

2014: Penalty is $95.00 or 1% of income

2015: Penalty is $325.00 or 2% of income

2016: Penalty is $695.00 or 2.5% of income

The challenge for many individuals, small business owners, and the self-employed is the budgeting for the new monthly expenses associated with the new insurance requirements. For individuals that are self-employed who also meet the requirements to qualify for a Federal healthcare insurance subsidy, it is vital that monthly and quarterly estimates on income be examined and managed by an accountant that understands the dynamics of the changes.

As an example, if you qualify for a subsidy based on previous income, and business picks up this year, and your income dramatically rises, you may have to repay part or even the entire subsidy back at the end of the year. This is a real and growing fear for many self-employed that are currently trying to budget their healthcare costs for the year. An accountant that is experienced in small business and sole proprietor finances can help you to keep track of your income and the potential impact it will have on a subsidy you are currently receiving.

The deadline for purchasing healthcare insurance to avoid the fine is March 31, 2014. If you qualify for Federal Subsidies, programs are available only through government exchanges, or your state’s exchange. However, you can forgo the subsidy (if you qualify) and purchase a program through the Exchange, or through a private insurance brokerage. There are other considerations too. In some cases, it may make sense to add full-time employees as it allows you to participate in the SHOP program. Having only independent contractors do not. This is something that needs to be analyzed by a expert accounting firm.

In Florida, and beyond, Barry Bandler Accounting & Tax Services can help you evaluate your current needs and help to prepare you for the tax and accounting consequences of the Affordable Care Act. Special considerations for small businesses and sole proprietors include:

-

Subsidies will not be treated as income, and therefore not taxable

-

Subsidies will have to be repaid if income rises this year

-

Budgeting for healthcare insurance premiums if income changes must be considered from the beginning

-

Self-employed must evaluate and continue to revaluate their revenues and expenses throughout the year

RESOURCES

http://www.irs.gov/uac/Small-Business-Health-Care-Tax-Credit-for-Small-Employers

http://www.nolo.com/legal-encyclopedia/what-obamacare-means-the-self-employed.html